In the midst of summer, as the heat rose and the U.S. saw record-breaking temps, another milestone emerged.

Gun sales.

Dipping below 1 million, the National Instant Criminal Background Check System reported the lowest background checks in six years in July. Though numbers rebounded in August, there are concerns over whether the gun industry has hit its own recession of sorts.

Summer months are notoriously slow for firearm retailers as summer vacations and time outside replace shopping.

But was July’s dip in sales an indicator of what’s to come? Should the industry brace for impact?

Table of Contents

Loading…

Summer Slump

NICS first reported the decline in background checks in early August, hinting that July had missed the mark in terms of sales.

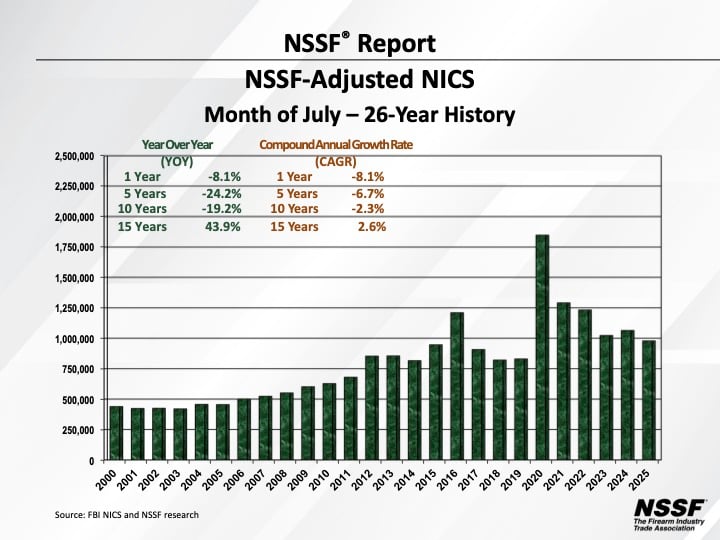

According to the National Shooting Sports Foundation, July’s numbers dipped 8% from the previous year, ending the six-year streak of over 1 million monthly background checks.

Retailers we talked to say the NSSF’s numbers align closely with what they’re seeing in stores and online. A summer trend characterized by decreasing sales and an increased hunt for the best value was noted by almost all the retailers we spoke to.

“We’re tracking very close to the national picture,” Kyle Smith of Sportsman’s Outdoor Superstore told Pew Pew Tactical in an email. “Year-to-date, our gun sales are down ~7% versus last year, which is slightly better than the industry’s July dip; so, we’re encouraged that our mix and merchandising are helping us hold share.”

Sales, even outside the firearms industry, tend to slow in the summer months as people turn to activities outside of shopping – often vacationing or spending time outdoors. Known as the Summer Slump, sales often slow down from June to September.

The firearms industry tends to track alongside traditional retail in that manner.

In 2024, NICS reported a 3% decrease from May to June but later reported a 9% increase in checks from September to October.

“The market during the summer is always softer, especially in our industry,” Smith said.

Shopping categories also tend to shift with the seasons, retailers told us, but more importantly, they are seeing a shift in buying habits.

Saddle Rock Armory, based in Texas, explained that summer months typically bring slower sales in certain firearm categories – like rifles – but more and more, the shop is seeing calculated purchases from consumers.

“I wouldn’t say that we’ve seen a slowdown as a whole, but we see customers being more intentional with their purchases, and we don’t blame them,” Charles Rudney, Owner of Saddle Rock, told us. “Some customers will come in with a strict budget, and we always do our best to outfit them with something that maximizes dollar value.”

Legislation Adds Fuel to the Fire

Though it’s easy to blame it on the weather and seasonal activities, legislation may also play a factor in consumers putting the brakes on new purchases.

In early July, President Trump signed the “One Big, Beautiful Bill,” a reconciliation bill that officially removed the $200 excise tax on suppressors, short-barreled rifles, and short-barreled shotguns.

Though shoppers will still have to fill out the same paperwork and register those items with the ATF, they will no longer have to pay the tax stamp come January 1, 2026.

Saddle Rocks’ Rudney said he feels like this is encouraging money-conscious consumers to hold off on purchases until then.

“I’ll say the biggest impact we’ve seen with legislation and 2025 sales impact has to do with suppressors,” Rudney explained. “Most people are waiting for the implementation of the $0 tax stamp coming January 2026. Typically, summer months are slower on rifle sales here due to the weather, but we think that rifle sales are slower because people are also waiting for the $0 tax stamp for SBRs.”

It’s common for gun sales to decrease during Republican presidencies. Republican administrations typically focus their efforts elsewhere, and fears around gun control, gun legislation, or restrictions lessen among consumers. The drive to buy just isn’t there.

Trump took office in January of this year, and Hyatt Guns wasn’t surprised that sales declined as a result.

“The obvious elephant in the room is a gun-friendly atmosphere in Washington,” Justin Anderson, Director of Marketing at Haytt Guns, said. “While it’s interesting to note that President Trump is one of only a handful of presidents that has done anything meaningful to hinder 2A rights through his now-overturned bump stock ban, the climate around gun control has quieted significantly.”

Changing Demographics

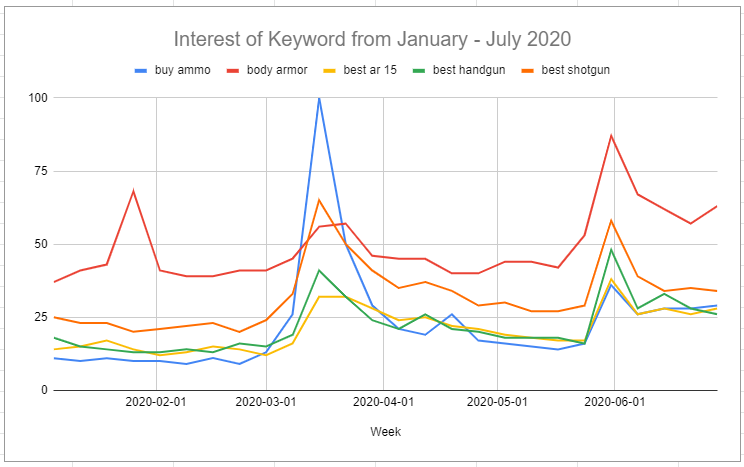

During the height of COVID in 2020 and 2021, the industry experienced an influx of first-time gun buyers spurred by pandemic-related fears and civil unrest.

Five years later, things have changed. While Guns.com noted a 20% increase from May through July in new gun owners, most retailers said repeat consumers are shopping more and more. (Guns.com did point out that they’ve seen a 30% growth in repeat customers during the same timeframe.)

Saddle Rock Armory said there are definitely fewer first-timers in their shop than they’ve seen in the past. Now, repeat customers are walking through their doors, looking for accessories to outfit previous purchases.

Anderson with Hyatt Guns pointed out that they’re seeing a bigger trend in minorities, including women, who are shopping for firearms in the summer months.

“The biggest trend is seeing many women and customers from underrepresented groups buying their first guns. Politics aside, the news cycles tend to drive these purchasing habits. People see violent crime in their newsfeeds, and that’s usually a driver of those who are on the fence to make that first purchase. This is not really a shift, but more growth in these segments,” Anderson said.

He noted that the industry is never quite linear, but a known driver of sales is fear. “The gun business ebbs and flows based on many factors, but the big driver of sales is ‘fear’ — fear of gun control measures, of becoming a victim of violent crime, etc. When the fear index trends up, so do gun sales.”

Budget Buys

Since overall sales have cooled off, what, then, are consumers focusing on as they shop?

Retailers say this generation of shoppers is all about getting the best bang for the buck.

“Customers are searching out value and are finding that value in our used firearms,” Smith explained.

Sportsman’s Outdoor Superstore’s used gun category has seen some significant growth as gun owners seek out the very best deals, stretching their dollar further with pre-owned guns. Smith said the company has seen a 40% increase year-over-year in the used category alone.

And this move towards value-driven purchases has pushed the company to adapt to meet that need.

“We are prioritizing value by taking in more used firearms and strengthening financing options, with Sezzle Pay-in-4 now available on our website,” Smith revealed.

Sportsman’s Outdoor Superstore isn’t the only retailer focused on budget buys and incentives designed to get consumers in the door and shopping.

Online retailer Guns.com said repeat customers are flocking to the site, on the hunt for discounts and manufacturer rebates.

“Pricing and promotional offers appear to be key drivers of consumer behavior, as we’ve observed an increasing number of customers actively seeking better deals,” Will Altherr of Guns.com told Pew Pew Tactical in an email. “Incentives such as free shipping on firearms have proven effective in boosting conversions, while the free tax stamp promotion remains a highly attractive offer for customers purchasing suppressors.”

Pew Pew Tactical conducted a survey of its own readers, and the results backed up what retailers are saying.

58% of polled readers said they wanted a price comparison tool on the site to easily compare prices among retailers, with 41% specifically mentioning the need for more deals.

But there are exceptions to the trend. Hyatt Guns tends to sell smaller guns in the summer months, but, interestingly, has observed an uptick in some higher value categories.

“Small concealable handguns are driving most of our new gun sales,” said Anderson.

“We’re also seeing a jump in sales of higher-value guns like over/under shotguns and collectibles. These have traditionally been mainstays of our business. Our size and our over 60 years in business allows us to get access to more of the hard-to-get and higher-value firearms.”

Summer 2025 & Beyond

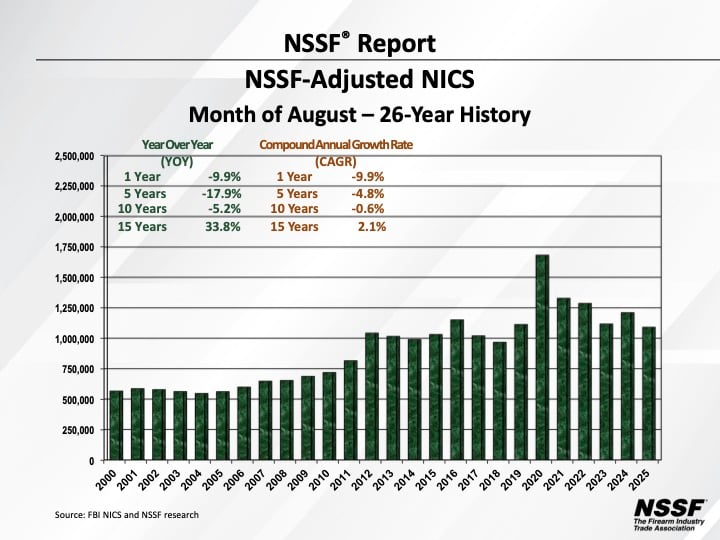

The summer months draw to a close, and August NICS numbers show a return to “normal,” topping out at over 1 million once more. Will this hold through the rest of the year?

Retailers are currently prepping for doorbusters and slashed prices as Black Friday, Cyber Monday, and Christmas loom just a few months away. Though Black Friday is traditionally the biggest shopping day of the year, tariffs introduced this year could impact holiday pricing. Consumers may notice steeper price tags as companies raise costs to offset tariffs.

That said, Rudney at Saddle Rock reminded us, there’s no need to go into debt for guns.

“With the economy slumped and people losing their jobs, don’t go into debt for a gun,” he warned. “If you’re stretched for expendable income, don’t be afraid to ask for a deal or to shop around. As a shop owner, I am competing for your business, and I’m willing to make sure your dollars are maximized here.”

Did you shop over the summer? Let us know what you bought? Saving up for Christmas? What’s on your list? Check out our Deals page and read up on our favorite Budget Handguns, Cheapest AR-15s, and Budget Red Dots.

4 Leave a Reply

Bought my first rifle over the summer. The Ruger 10/22 came in a case with a Viridian Eon 3-9 x 42 scope mounted. It was on sale at Cabelas.

Great buy, Jonathan, and welcome to the family!

Congrats on the new rifle! The 10/22 is a fantastic one to start with!

It’s of note that recently internet searches in America for “help paying mortgage” and “credit card debt” are at levels that have surpassed that of the 2008 financial crisis. The government has also recently chosen to no longer put out job reports or report on the rate at which people are going hungry in the country. I believe unfortunately that the declining sales of firearms is going to be one of many industries and folks that are going to be going through extremely difficult times.